43+ does debt to income ratio include mortgage

Web What is debt-to-income ratio for mortgage loans. Web Your debt-to-income ratio DTI helps lenders decide whether to approve your mortgage application.

Bank We Offer Tools Resources For Navigating Home Loans From Start To Finish.

. Web As one of the most used variables to get approved for a loan debt-to-income ratio is calculated based on your monthly debt payments and divided by your gross. A debt-to-income ratio for mortgage loans is a simple ratio measuring how much of your income goes towards. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

When you apply for credit your lender may calculate your debt-to-income DTI ratio. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. Web Another number many lenders consider before they decide you qualify for a HELOC is your debt-to-income ratio or DTI.

Baca Juga

This calculator is for educational purposes only and is not a denial or approval of credit. Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA. 43 is getting into the higher interest rate products that can.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. But what is it exactly. Ad Eased Requirements Make Qualifying For Lower Rates A Snap.

Web Your DTI ratio should include all revolving and installment debts car loans personal loans student loans mortgage loans credit card debt and any other. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Web To qualify for an FHA loan you generally must have a FICO score of at least 580 and a debt-to-income ratio DTI of 43 or less including student loans.

Web Calculating your debt-to-income ratio DTI measures your debts as a percentage of your income. Lenders prefer to see a debt-to. This number is one way lenders measure your ability to.

Your debt-to-income ratio is the total of all your. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032.

Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments. Bank Is One Of The Nations Top Lenders. Simply put it is the percentage of your monthly pre-tax.

Web Smaller creditors are exempt from rules governing Qualified Mortgages and may therefore issue favorable mortgage loans to borrowers with debt-to-income ratios. Web Debt to income ratio includes housing plus your other debts and should really be under 36 or so. Multiply that by 100 to get a.

Web Your debt-to-income ratio DTI is all your monthly debt payments divided by your gross monthly income. Ad Eased Requirements Make Qualifying For Lower Rates A Snap. Debt can be harder to manage if your DTI ratio falls between.

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

What S A Good Debt To Income Ratio For A Mortgage

Excel Spreadsheet Example 43 Free Excel Documents Download

Calculating Your Debt To Income Ratio How To Guide

List Of Top Personal Loan Providers In Ranikuthi Best Personal Loans Online Justdial

Understanding Dti Debt To Income Ratio Home Loans

Debt To Income Ratios Home Tips For Women

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

What Debt To Income Ratio Is Needed For A Mortgage Tally

What Debt To Income Ratio Is Needed For A Mortgage Tally

Pdf Low Income Students Human Development And Higher Education In South Africa

Business Succession Planning And Exit Strategies For The Closely Held

Understanding Dti Debt To Income Ratio Home Loans

What Debt To Income Ratio Do You Need For A Mortgage

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

How Debt To Income Ratio Affects Mortgages

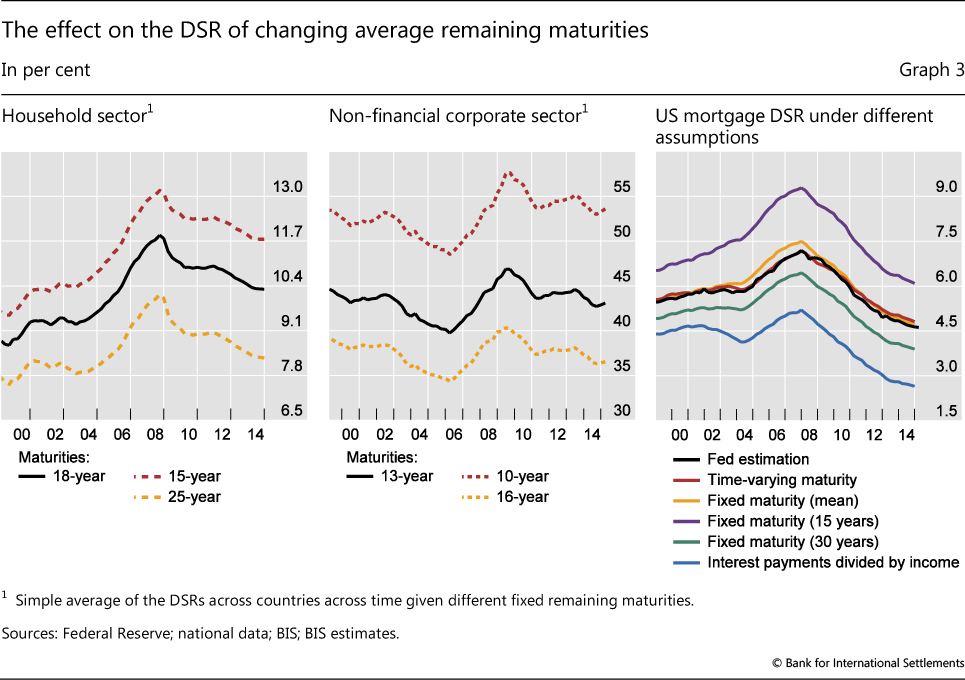

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios